Business Taxes

Budget 2020: overview of tax issues

1. Business Taxes

1.1. Corporation tax

The UK’s Corporation Tax main rate for the financial year beginning 1 April 2020 will remain at 19% [Paragraph 1.211 of the Budget 2020]. The expected tax rate at 17% has been cancelled.

Changes for non-UK resident companies with UK property income

Non-UK resident companies that carry on a UK property business or have other UK property income brought within the scope of Corporation Tax from 6 April 2020 rather than that income being charged to Income Tax as is the present situation. This measure is not expected to have any significant economic impacts.

Corporate capital loss restriction

The government restricts companies’ use of carried-forward capital losses to 50% of capital gains from 1 April 2020. The deductions allowance can now also be set against chargeable gains.

The restriction included an allowance that the first £5 million of profits per group could be offset with carried-forward losses before the 50% restriction is applied. Therefore, over 99% of companies are unaffected by these restriction and will be able to use full allowances [Paragraph 2.207 of the Budget 2020]. The will be exclusion from the scope of the restriction for certain companies in liquidation.

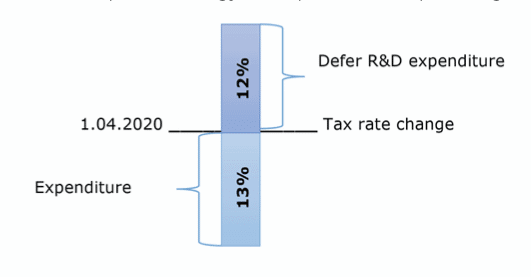

Research and Development Expenditure Credit (RDEC)

The RDEC rate will increase from 12% to 13% from 1 April 2020, supporting businesses investing in R&D [Paragraph 2.1 of the Budget 2020; Section 104M of CTA 2009]. The RDEC is a standalone credit that is brought into account as a receipt in calculating trading profits. Companies can reduce their tax bill or claim payable cash credits as a proportion of their R&D expenditure.

Example 5. Strategy of Corporation Tax planning

Clarification: UKCo general tax planning strategy should be to defer R&D expenditure and make full use of them after rate change.

Intangible fixed assets

There have been changes which affect companies that acquire intangible fixed assets (e.g. intellectual property such as trademarks, design rights, patents etc.) from related parties.

The measure amendments the corporate “IFA regime” to allow companies to claim corporation tax relief for pre-FA 2002 intangible fixed assets acquired from related parties from July 1, 2020 [Paragraph 2.206 of the Budget 2020]. Therefore this corporation tax relief will be available to use for the cost of acquiring these assets in circumstances where it wasn’t previously and that corporate intangible assets will now be relieved and taxed under a single regime for acquisitions.

Thus, this provision removes a restriction that exists in relation to pre-FA 2002 intangible assets that prevents some companies from claiming relief for older, well-established intellectual property rights.

The additional (transitional) rules will be introduced in order to protect companies holding intangible assets between 11 March 2020 and 30 June 2020. This measure included the companies with accrued gains or losses on intangible assets dealt with under the capital gains rules.

Annual Investment Allowance

Annual Investment Allowance remains until the end of year. 100% AIA on £1,000,000 expenditure incurred between 1 January 2019 and 31 December 2020. This will revert to £200,000 AIA on expenditure incurred on or after 1 January 2021.

Structures and Buildings Allowance (SBA)

The annual rate of the SBA will increase from 2% to 3% from 1 April 2020 for corporation tax purposes. For businesses within the charge to income tax, the operative date is 6 April 2020 [Paragraph 2.198 of the Budget 2020].

This measure is applicable for businesses incurring qualifying expenditure on non-residential structures and buildings newly constructed, or renovated under contracts which were entered into on or after 29 October 2018.

Companies that were entitled to claim the SBA for structures or buildings brought into use between 29 October 2018 and 1 April 2020 can claim the new 3% rate for corporation tax from the operative date.

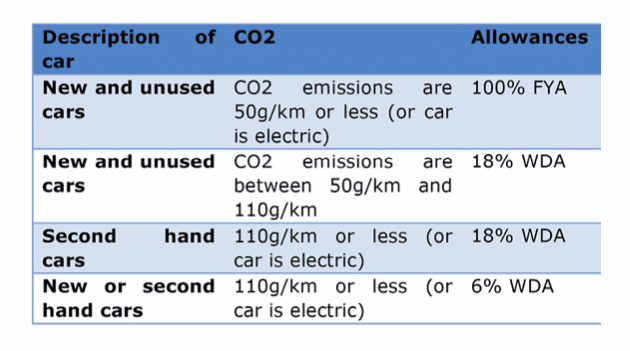

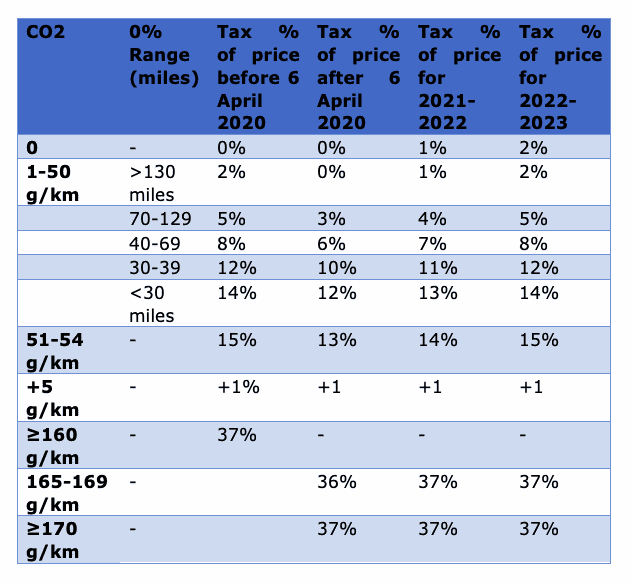

1.2. Low Emission Cars Allowance

If a UK company buys a new motor car that emits no more than 50g/km CO2, the car will qualify for 100% First Year Allowance (FYA) which means that the full cost may potentially be set against business profits. New cars provided to employees and available for private use which are first registered on or after 6 April 2020 will be taxed according to the CO2 emissions figure, measured under the Worldwide Harmonised Light Vehicle Test Procedure (WLTP) system. If the electric car (no CO2 emissions) is provided as a UKCo car to an employee the benefit in kind may be 0% from 6 April 2020 [Paragraph 2.4 of the Budget 2020].

Capital allowances

Car Tax Benefit

The government also reduced most company car tax rates by 2% in 2020-21 for cars registered from 6 April 2020. Rates will return over the following 2 years, increasing by 1% in 2021-22 and 1% in 2022-23.

1.3. Property tax

Non-UK resident SDLT surcharge

The Budget 2020 introduced a 2% Stamp Duty Land Tax surcharge on non-UK residents purchasing residential property in England and Northern Ireland. It will take effect from 1 April 2021.

Relief for housing co-operatives

The Budget 2020 introduced new reliefs from the ATED and the 15% rate of SDLT for certain qualifying housing cooperatives.

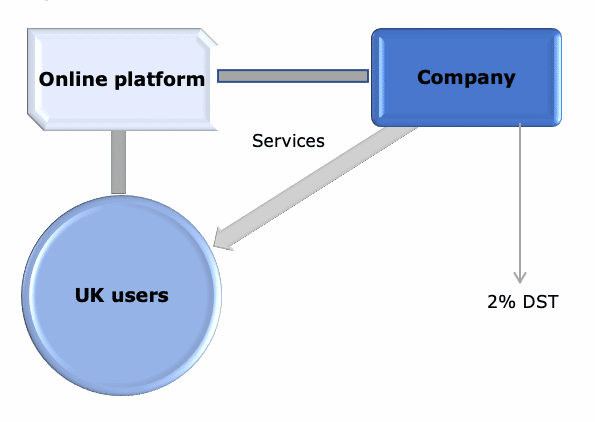

1.4. DST

The DST is a new tax on the revenues of certain digital businesses, intended to ensure those companies pay the amount of tax in the UK which is proportionate to the value they derive from UK users. [Paragraph 2.205 of the Budget 2020]

Who the measure is aimed at?

This measure affects large groups of companies with revenue derived from the provision of a social media service, a search engine or an online marketplace (excluding financial services providers but including online advertising service providers), which meet the following criteria:

a) group worldwide revenues from these digital activities are more than £500,000,000; and

b) group revenues derived from UK users are more than £25,000,000.

The total DST liability will be calculated at the group level and charged to individual legal entities within the group. A single entity in the group will be responsible for reporting the DST to HMRC.

What is the essence of such a scheme?

If the group’s revenues exceed the above thresholds, its revenues derived from UK users will be taxed at a rate of 2%. There is an allowance of £25,000,000. Thus, a group’s first £25,000,000 of revenues derived from UK users will not be subject to DST.

The conditions

DST will take effect from 1 April 2020.

A UK user is an individual that is normally located in the UK, or other type of user established in the United Kingdom.

Taxable revenues will include any revenue earned by the group connected to a social media service, search engine or online marketplace irrespective of how the service is monetised. The revenue charged will be reduced to 50% of the revenues from the transaction when a user in respect of a marketplace transaction is normally located in another country that operates a similar tax to the Digital Services Tax.

The DST will be payable and reportable on an annual basis.

Continue to Part II, Additional Business Measures